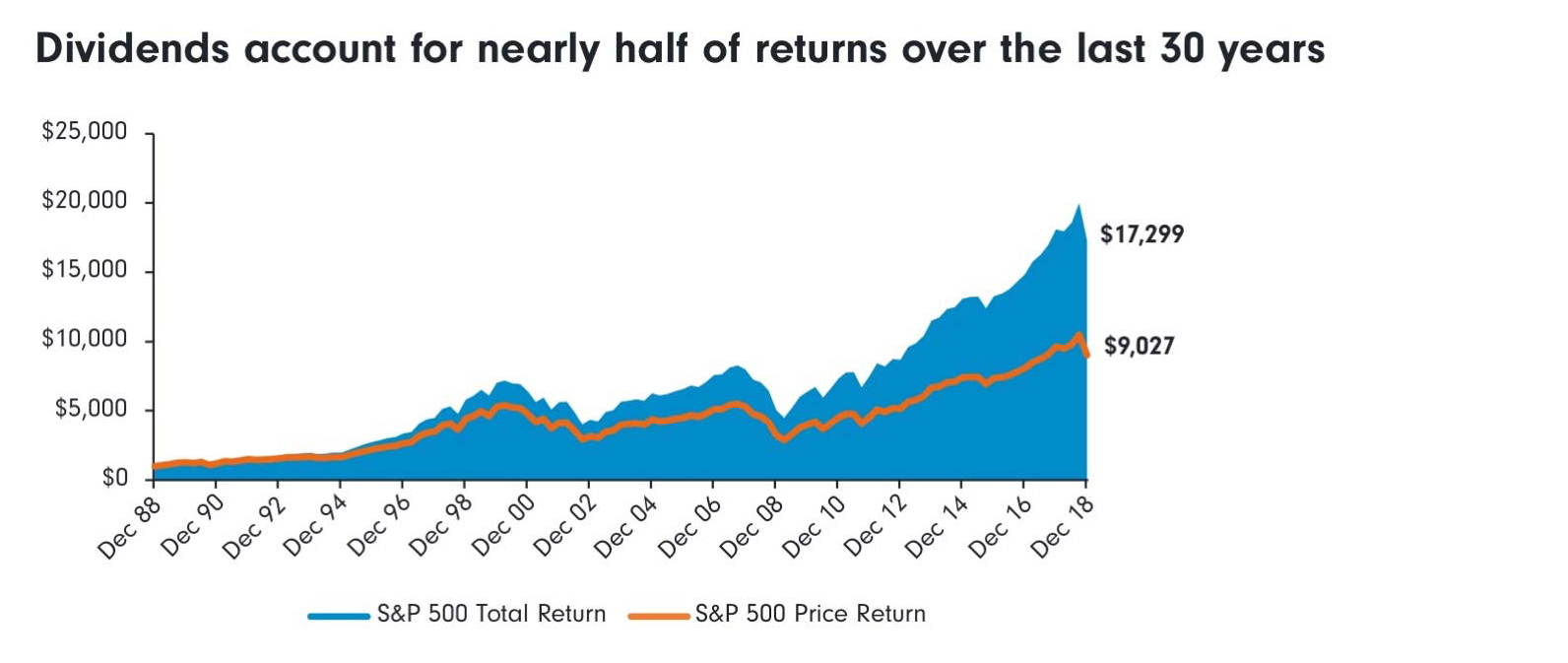

Dividend investing has long been a favored strategy for those seeking stable income while building wealth. In addition, dividends account for nearly half of returns over the last 30 years for S&P 500 companies (Source: Fidelity International, 2024).

However, choosing the right dividend-paying stocks requires more than just selecting companies with high yields. Here are the top 7 considerations that every investor should look out for when it comes to dividend investing.

1) Dividend to Free Cash Flow Payout Ratio and Trend

A company’s dividend payout ratio, relative to its free cash flow (FCF), is a critical metric for dividend sustainability. The free cash flow payout ratio shows how much of the company’s available cash is being used to pay dividends.

Key Points to Consider:

• A low payout ratio indicates that the company is retaining enough cash to reinvest in growth while paying dividends.

• Consistency in both free cash flow and dividend payouts is vital. Watch for companies with stable or growing FCF over time.

• A trend of rising dividends supported by rising FCF signals good financial health.

2) EBITDA to Interest Coverage Ratio

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is an important measure of a company’s ability to cover its debt obligations, especially interest payments. A company with a low payout ratio relative to EBITDA is more likely to sustain its dividend payments even during periods of financial stress.

Key Points to Consider:

• The higher the EBITDA/interest coverage ratio, the more easily the company can meet its interest expenses, reducing the risk of dividend cuts.

• Look for companies that are not overly stretched in paying out dividends, which can ensure better resilience in tough economic times.

3) Revenue, Earnings, and Dividend Growth Rate and Trend

Sustainable growth in revenue and earnings is essential for a company to maintain or increase dividend payouts over time.

Key Points to Consider:

• Analyze the growth rate of a company’s revenue, earnings, and dividends. A consistent upward trend is a positive indicator of financial health.

• Companies with increasing dividends and earnings over time tend to attract long-term investors and support stock price appreciation.

4) Return on Invested Capital (ROIC)

ROIC measures how efficiently a company is using its capital to generate profits. A high ROIC often indicates a company is deploying its resources effectively, which can translate to consistent or growing dividend payouts.

Key Points to Consider:

• Companies with high ROIC tend to have more free cash flow to support dividends, making them more attractive for dividend investors.

• Look for businesses with a track record of maintaining or improving their ROIC over time, as it indicates sound management and profitable growth.

5) Dividend Yield

Dividend yield is often the first metric investors look at, but high yield alone isn’t always a good sign. A company’s ability to sustain its dividend yield over the long term depends on its financial health and growth prospects.

Key Points to Consider:

• Compare the dividend yield with the industry average to avoid “yield traps,” where a high yield may indicate an unsustainable payout.

• Aim for companies with a reasonable yield that aligns with their payout ratio and growth potential.

6) Potential for Capital Gains (Fair Value Considerations)

Dividend investors should also consider the potential for capital appreciation alongside income from dividends. While dividends provide regular cash flow, the potential for stock price appreciation can significantly enhance total returns.

Key Points to Consider:

• Evaluate whether the stock is trading near its fair value using valuation metrics like the Price-to-Earnings (P/E) ratio or Discounted Cash Flow (DCF) analysis.

• Look for undervalued dividend stocks that have room for growth, as this can provide both income and capital gains over time.

7) Debt-to-Equity Ratio

A company’s debt level is crucial to understanding its long-term financial stability. The debt-to-equity ratio shows how much debt a company is using to finance its assets relative to shareholder equity.

Key Points to Consider:

• A high debt-to-equity ratio may indicate the company is over-leveraged, which can be risky if it faces financial difficulties.

• Look for companies with manageable debt levels. A lower debt-to-equity ratio often indicates a company is on a solid financial footing, with less risk of needing to reduce or suspend dividend payments during tough times.

Conclusion

Dividend investing can be a rewarding strategy if approached with careful consideration. By looking beyond just high yields and focusing on key financial metrics like free cash flow payout ratio, earnings growth, ROIC, and debt levels, investors can build a robust dividend portfolio that delivers consistent income while minimizing risk. Always remember that sustainable dividend payments and the potential for capital gains are essential for maximizing long-term returns.

Are you ready to dive deeper into dividend investing? Stay tuned to DividendHavenSG for more insights and expert tips!